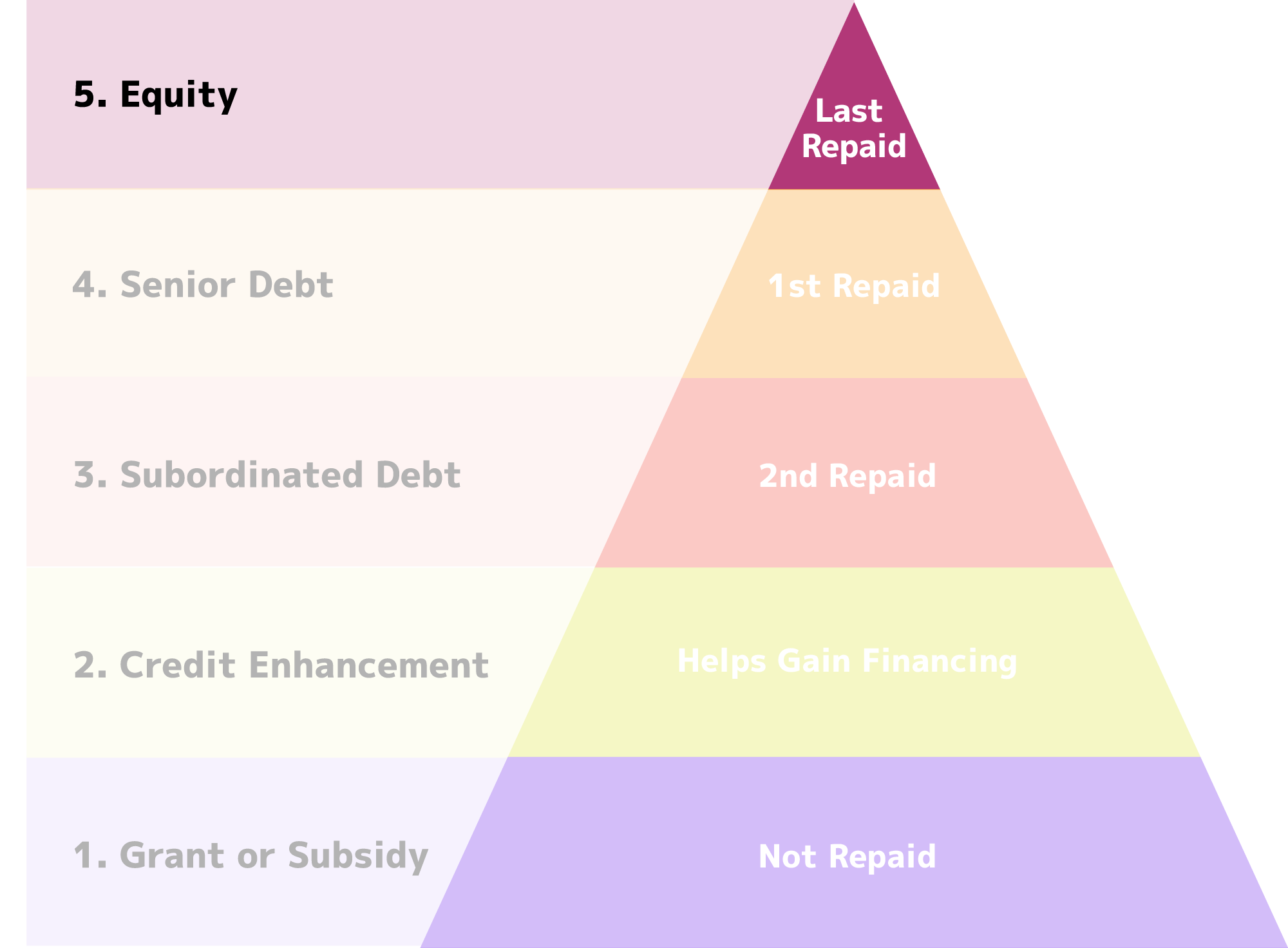

Capital Stack:

Equity

Traditional Equity Financing (Repayable): Equity does not necessarily mean selling a part of a business to someone else. Sometimes a business or organization will provide this type of capital for themselves if they have sufficient capital and wish to be the sole owner. However, when capital is invested this way by a different party, the investor’s capital purchases a portion of the company or project—known as equity. This is the riskiest type of financing because this investor is the last to be paid back. However, it also has the potential to be the most lucrative, especially if the investors can avoid the use of brokers or middlemen. A good example is East Portland Community Investment Trust (CIT) in Portland. In 2014, the East Portland CIT purchased a $1.2M strip mall located in a high-density, low-wealth neighborhood that was becoming vulnerable to gentrification. It now leases spaces at the mall to local businesses and has sold affordably priced ownership shares in the mall, known as Plaza 122, to 140 low-income families who live in adjacent neighborhoods. According to the Kresge Foundation, each family has received an average annual dividend of 9.3 percent. Of these families, the majority are people of color and more than half are immigrants. The investment performs well and generates more revenue than expected for these families. Plus, the Equity Investors gain an ongoing portion of that revenue indefinitely. It’s a win-win scenario for all.

Equity Investors: These are investors who provide capital for a company in exchange for owning a share of the company.

Angel Investors: This is a type of equity investor geared toward supporting new companies. These are usually high-net worth individuals who provide financial backing for small startup companies in exchange for owning a portion of that company (i.e., equity). Country Roads Angel Investors (CRAN) is part of the national angel investors network. Also, as of October 2021, the Appalachian Investors Alliance (AIA) had 130+ AIA accredited investor members who have launched eight (soon to be 11) angel/impact funds in as many Appalachian states which have placed $10 million in direct private investment into 34 entrepreneurial companies.

Community Equity: Community equity allows both wealthy people (i.e., accredited investors) and anyone else in a community to invest. This means both wealthy and non-wealthy people alike are invited to invest and have equity. Typically, a business owner or the leaders of an organization will advertise the investment opportunity to the public. Community Equity often attracts first-time investors.

Venture Capital: Venture capital is money available for repayable investment in startup enterprises and innovative small businesses with high growth potential. These potentially lucrative investments often are accompanied by significant risk. A good example of Venture Capital in Appalachia is AppHarvest.